corporate tax increase build back better

Bidens tax proposal in infrastructure plan would hurt the US against competitors like China. Increase to capital gain rate.

Policymakers Should Craft Compromise Build Back Better Package Center On Budget And Policy Priorities

The Financial Accountability and Corporate Transparency FACT Coalition urges Congress to advance needed international tax reforms as part of the 2021 budget reconciliation process by passing the Build Back Better Act HR.

. The House of Representatives on Friday morning passed HR. Since the legislation is still under consideration it is possible. The bill also violates President Bidens pledge to oppose even a penny more of new or higher taxes on Americans making less than 400000.

1 A corporations taxable income that does not exceed 400000 would be subject to an 18 tax rate. 5376 the build back better act. The House-passed Build Back Better legislation is expected to be revised by the Senate which would then require further action by the House.

Create a 1 excise tax on net stock buybacks. This legislation could result in increased deal pricing and costs for MA so we may see. The Build Back Better Act which is currently under Congressional consideration would help to create jobs reduce expenses and cut taxes.

The corporate income tax rate would increase and be restructured into a graduated format with rates running from 18 to 265 with a flat 265 applicable to large corporations. Congress should enact the pro-worker international tax reforms in the Build Back Better framework. The House on November 19 voted 220 to 213 to pass the Build Back Better reconciliation bill HR.

In addition one of the major tax increases in the bill the corporate minimum tax on book income isnt scheduled to take effect until 2023. President biden has proposed to raise the corporate tax rate. TPC allocates corporate taxes to households as investors and workers.

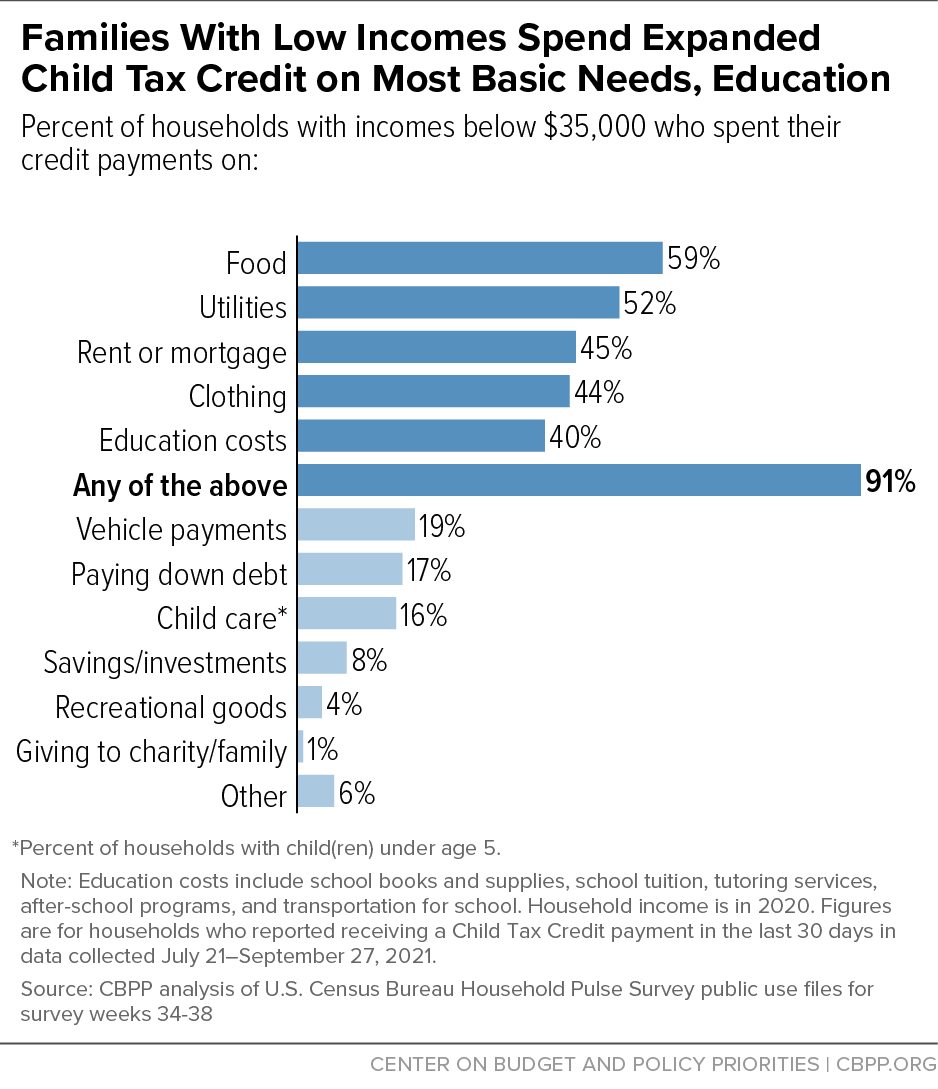

Impose a 15 percent minimum tax on corporate book income for corporations with profits over 1 billion-01-01-03-01-27000. Individual and pass-through tax. Impact of Tax Increases that Could Fully Pay for Build Back Better Long-run GDP Long-run Full-time Equivalent Jobs millions Long-run After-tax Income of Middle Class 10-Year Static Tax Revenue trillions Add a Flat Individual Income Tax of 5-21-22-44.

In general the combined effects of these changes would result in many households paying higher taxes in 2023 than in 2022. Despite what its promoters say. 5376 that includes more than 15 trillion in business international and individual tax increase provisions.

The Build Back Better Act that just passed the House would directly address this problem for the first time in more than 30 years. For corporations that report 1B or more in profits the proposed 15 corporate minimum tax. For more on the nontax provisions of the bill see House Passes Build Back.

The bill would increase taxes on businesses by more than 1 trillion taxes paid by workers in the form of lower wages and consumers in the form of higher prices. Increased deal pricing for MA. The revised bill makes significant changes to and departures from the tax proposals approved in the September 13 2021 version the September version 1 not to mention brushing aside the Senate Finance Committees Billionaires Tax.

Corporate Tax Increase Build Back Better. Miscellaneous corporate tax increases-01-01-02-01-17000. According to a fact sheet from the White House a new Treasury Department analysis shows that the proposal wouldnt increase income tax rates on 97 of small business owners and would provide.

Build Back Better and OECD Corporate Tax Agreement Would Discourage Offshoring Jobs and Profits. What Build Back Better means for businesses Effective rate increases. The bill encompasses a wide range of budget and spending provisions and has been the focus of protracted negotiations for the past several weeks.

5376 the Build Back Better Act by a vote of 220213. President Joe Bidens Build Back Better agenda would raise taxes on up to 30 percent of middle-class families despite his campaign promises saying otherwise. The price tag is estimated at 35T and will be primarily paid for through targeted tax changes on the wealthy and large corporations.

5376 the Build Back Better Act. Federal revenues will stem from tax increases on the wealthy and corporations. General Corporate Tax Provisions.

The Act would generally impose a 15 corporate alternative minimum tax the Corporate AMT on the adjusted financial statement income AFSI of any corporation other than an S corporation regulated investment company or real estate investment trust with a three-year average AFSI. Under the bill IRS bureaucracy. Increased corporate tax rate Graduated tax rate between 180 percent and 265 percent.

Increase to individual tax rate Top individual tax rate increased back to 396 percent. The corporate tax increase proposal in. The Ways and Means Committee proposed a graduated rate structure for most corporations.

Raise Individual Income Tax Rates by 10-09-10-11. A key provision in the bill known as the corporate alternative. The latest framework for the legislation proposes changes to the tax code that would the White House says raise more than 199 trillion to cover their 175 trillion Build Back Better agenda.

Not only will President Bidens Build Back Better Agenda protect more than 97 percent of small business owners from income tax increases it will also provide well-deserved tax cuts to Main. The international tax reforms included in the Act would decrease tax haven abuse and the offshoring of jobs while raising revenue for. Build back better would impose a surtax of 5 percent on adjusted gross income agi between 10 million and 25 million and 8 percent on agi exceeding 25 million.

If the corporations income exceeds 400000 but does not exceed 5 million it would be subject to a 21 tax rate and if the corporate income exceeds. November 19 2021. On October 28 2021 the House Rules Committee released a revised version of HR.

Build Back Better is slated to raise 1 trillion in revenue over the next decade. Corporate Alternative Minimum Tax.

Infographic 5 Reasons For Upgrading To Magento 1 8 Magentoce Community Edition Magento Infographic Upgrade

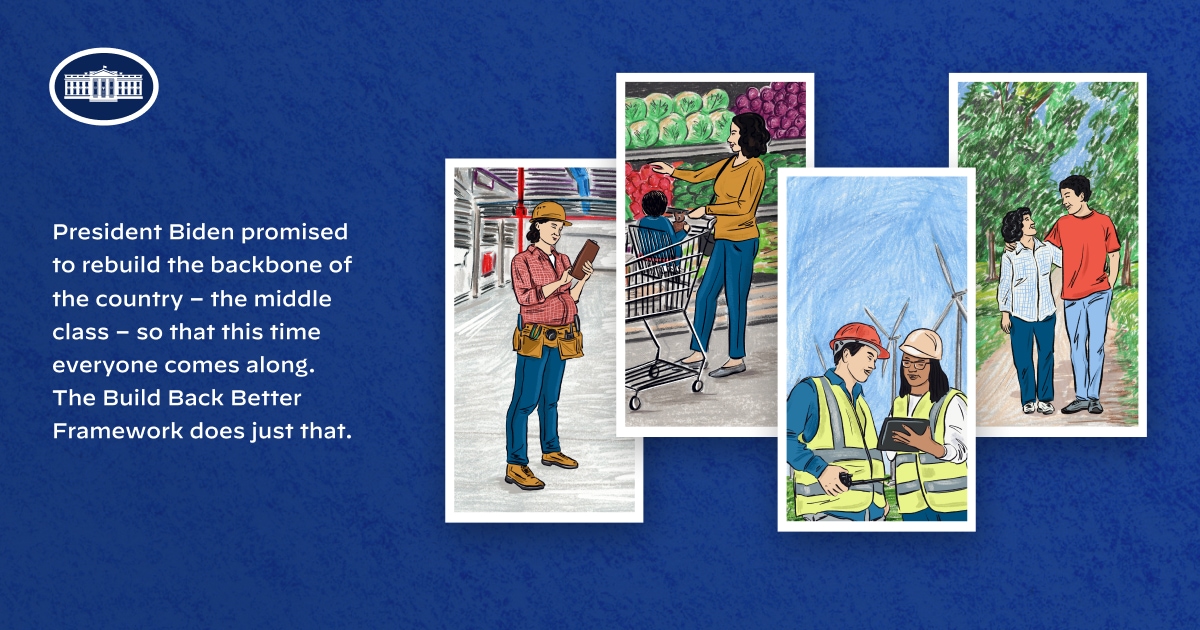

The Build Back Better Framework The White House

Tracking Changes In Income Statements With Waterfall Chart Oc Chart Information Visualization Data Visualization

The Build Back Better Framework The White House

7 Factors Driving Electric Vehicles Ev S Adoption Electric Cars Electricity Adoption

Manchin Says Build Back Better Is Dead Here S What He Might Resurrect

Us Treasury Pushes Back As Budget Office Warns Biden S Bill Will Swell Deficit As It Happened Us Politics The Guardian

The Build Back Better Framework The White House

Ey Are You Prepared For Corporate Reporting S Perfect Storm Complexity And Demand Continue To Rise Perfect Storm Finance Infographic Finance Function

Esg Sustainable Impact Metrics Msci Investing Infographic Sustainability Sustainability Consulting

Business Setup Chartered Accountant Internal Audit Business

Have More Money Money Management Advice Finance Investing Investing Money

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

Policymakers Should Craft Compromise Build Back Better Package Center On Budget And Policy Priorities

The Build Back Better Framework The White House

Pin By Steph Johnson On Politics Letter To The Editor Brookings Low Taxes

Pin By The Intelligent Investor On Money In 2022 Money Strategy Trading Charts Money Saving Plan

/cdn.vox-cdn.com/uploads/chorus_asset/file/23321099/1239105365.jpeg)

Three Ways Democrats Build Back Better Bill Could Go From Here Vox